Making Dental Care More Affordable with Your FSA or HSA

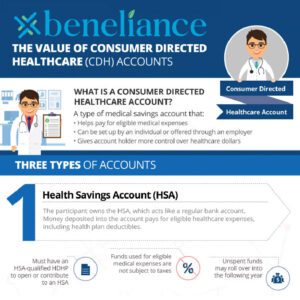

Dental care can be expensive, starting with monthly insurance premiums. Basic coverage often includes annual checkups, cleanings, and x-rays. However, it may not cover costly procedures like fillings, root canals, or orthodontia. This can leave patients paying a significant amount out of pocket, straining their finances. Luckily, if you have