HSA

Understanding the HSA Withdrawal Penalty

Many people like Health Savings Accounts (HSAs). They save on taxes and set aside money for medical expenses. When you join an HSA-qualified health plan and sign up for an HSA, you put pre-tax money into an account. You can then withdraw the funds for qualified healthcare expenses. The IRS defines these

HSA Contribution Limits

An important part of consumer-directed healthcare (CDH), HSAs offer participants enrolled in HSA-qualified (HDHP) health plans a way to save on taxes while setting aside money for out-of-pocket healthcare expenses for themselves and their families. Recently, the Internal Revenue Service (IRS) announced updated annual HSA contribution limits for 2026. 2026

How Mid-Year Coverage Changes Impact HSA Contribution Limits

HSA owners can change their contribution amount at any time during the plan year, subject to the annual limit. (Annual contribution limits are set by the IRS each year.) However, their annual limit will differ if they have a mid-year coverage change from individual HDHP coverage to family HDHP coverage

Medicare and HSA Contributions Overview

Specific rules govern whether or not an employee can actively contribute to a Health Savings Account (HSA). One requirement is that they be enrolled in a qualified high-deductible healthcare plan (HDHP). Another is that they cannot be enrolled in any form of Medicare. Here are some things you should know

Heart Health and Your Benefits

Cardiovascular disease is the number one killer of women as well as men in the United States. February is American Heart Month, encouraging us all to learn more about our heart health. Let’s discuss a little about heart health and how your employer-sponsored benefit accounts may help. Women’s Heart Health

Financial Benefits Make a Difference

In 2023, Bank of America’s Annual Workplace Benefits Report reported that an all-time low of only 42% of employees feel financially well. Since financial stress may lead to employee absenteeism, lower productivity, and health problems like high blood pressure, anxiety, and depression, employers may want to consider adding financial benefits

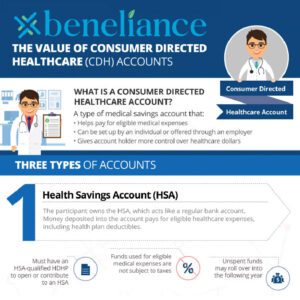

The Value of Consumer Directed Healthcare Accounts

The infographic below details the value of consumer-directed healthcare accounts. Learn more from this overview of HSAs, HRAs, FSAs, and other helpful information. What is a Consumer Directed Healthcare Account? A consumer-directed healthcare (CDH) account is a type of medical savings account that: There are three primary types of CDH