HRA

What is an HRA?

Health Reimbursement Arrangements (HRAs) are tax-advantaged accounts designed to reimburse individuals for qualified healthcare costs. Introduced by the IRS in 2002, HRAs are benefits that employers can offer to current and former employees, including retirees. Over time, legislative and regulatory changes have updated HRA rules and introduced new types, such

Heart Health and Your Benefits

Cardiovascular disease is the number one killer of women as well as men in the United States. February is American Heart Month, encouraging us all to learn more about our heart health. Let’s discuss a little about heart health and how your employer-sponsored benefit accounts may help. Women’s Heart Health

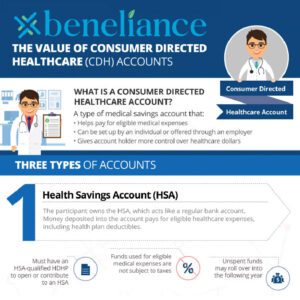

The Value of Consumer Directed Healthcare Accounts

The infographic below details the value of consumer-directed healthcare accounts. Learn more from this overview of HSAs, HRAs, FSAs, and other helpful information. What is a Consumer Directed Healthcare Account? A consumer-directed healthcare (CDH) account is a type of medical savings account that: There are three primary types of CDH

Missed Open Enrollment?

As open enrollment winds down, some participants may determine that they have elected too much or too little coverage for next year, while others who ignored enrollment may wish they had chosen something. The good news is that options may still exist. Health Plans Current enrollees in an existing health

What is a Summary Plan Description?

If you receive healthcare benefits from your employer, you will also receive a Summary Plan Description (SPD). Required by law, the SPD defines plan eligibility and explains benefit calculations and payments, how to submit claims, when benefit guarantees begin, and more. Here’s what you need to know about your Summary

What is Healthcare Consumerism?

Healthcare consumerism is a movement to refine the efficiency and affordability of healthcare services by changing how people prioritize their healthcare. Imagine a system where patients are more knowledgeable and active in purchasing healthcare services. Healthcare consumerism works to make this a reality. Healthcare Consumerism Basics At its core, healthcare

Can I Have an HRA and HSA Simultaneously?

Healthcare spending accounts, such as Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs), help people pay for qualified medical expenses. They also provide more control over how and where to pay for those expenses. Some employees may have simultaneous HRA and HSA eligibility through their employer or when combined

FAQs About HRAs

Health Reimbursement Arrangements (HRAs) help employees pay for out-of-pocket medical expenses for themselves and their covered dependents. The sponsoring employer chooses the amount available each year and the eligible expenses. Below are answers to common questions about these tax-advantaged accounts. Frequently Asked Questions What is a Health Reimbursement Arrangement? An

HRA Plan Facts: Qualified Expenses, Taxes, and More

Health Reimbursement Arrangements (HRAs) are employer-sponsored plans that reimburse participants for qualified expenses. These accounts are entirely funded by the sponsoring employer. Let’s learn more about HRAs by looking at plan facts like qualified expenses, taxes, and more. Generally, there are no limits on employer contributions to regular HRA plans.